.png)

.png)

What does recurring payment mean? Recurring payment is a payment model where the customers authorize the merchant to pull funds from their accounts automatically at regular intervals for the goods and services provided to them on an ongoing basis. Cashflow is going to be the intermediate between the merchant and customer making it easy for customers to keep track of their payments all in one place.

Duration: 8 weeks

Project Role: UX Researcher, UI/UX Designer.

Tool: Figma, Sketch, Mockup.

People forget to pay their bills at the right time thereby leading to financial stress, conflict and other consequences. Knowing when your bills are due and making a habit of paying them on time can reduce your stress, save you money, boost your credit score, and enable you to get lower-interest credit in the future. Research from 2018 Consumer Credit Card Report, NerdWallet surveyed 2019 U.S. adults found that: 35 percent simply forgot to make the payment, 33 percent needed the money to pay for essentials, 32 percent needed the money for an unexpected expense. This lead to my initial question:

"How might we help people to remember to pay their bills at the right time?"

Cashflow is an automated payment application which helps people pay their bills at the given time. This ” set it and forget it ” mechanism relieves the customers of the task of making sure the bill is paid every cycle.

.png)

I adopted the Design thinking process which was a a non-linear process, it was a iterative process in which I used to understand users, challenge assumptions, redefine problems and create innovative solutions to prototype and test.

.png)

The goal of the research was to identify and further understand peoples, motivations and problems in relations in paying their bills. I performed an online survey of ten participants from ages 20-70. The research revealed that 80% of people have a lot of bills to pay and often can't keep track of all of them thus forgetting to pay one thing or the other, 60% say that they tend to procrastinate the payment thereby spending it on other things, 85% others said they simply forget to pay their bills at the right time . That suggested an opportunity for introducing prompt and organised payment experiences.

1. Analyse current payment solutions

2. Understand the user journey of a worker paying his bills

3. Understand how the user keeps track of his bills to be payed

The goal of the user interview was to collect more data from people who pay bills most especially workers and elderly people . I interviewed five people from the age of 20 to 70 living in my neighborhood. I found three major problems they are facing related to payments of bills. During the interview, most old people and young professionals often pay bills and have expenses to handle.

Therefore, our target users would be elderly persons and young professionals, especially those who earn a living.

The above findings helped us further narrow down our problem statement, so we came up with our final design question:

1. Introduce an automated payment system method.

2. Allow users receive notification alerts about upcoming bills to be paid.

3. Allow users manage and see all their past and future bills all in one place.

4. Enable users switch between tracking off bills and monthly subscriptions.

Based on the opportunity areas I summarized, I defined Cashflow's product structure. Users can view all their upcoming and paid bills all-in one place. they can also switch tabs between their bills and subscriptions.

.png)

Goals

•Brainstorm how to make the ATM card as visually appealing and simple as possible

•Consider how to display information as clearly on the homepage as possible

•Explore ways to display billing history information visually

.png)

Feedback indicated that the chart, home page, needed improvements.

.png)

Home Page: Participant suggested that the home page is not so clear and easy to understand. "It seems to cluttered"

I applied this feedback to create some low fidelity mock-ups.

Goals

•Refine home screen

•Refine visual design

•Add an active state for icons on bar

Home Screen: Feedback suggested the option for a "pay now" feature should be included in the upcoming payment.

Home Screen:Participant suggested that there should be a way to add new payment right by clicking a button from Home screen.

.png)

Adam is an old man who struggles with dementia he forgets to pay his bills in due time and thus costs him a lot in the long run.

Frustrations

• Annoyed that he always forgets to pay one bill or the other at the appropriate time

• Wished he could find an app to help with his bills management

• Annoyed that his condition affects a lot of his daily activities

"I live alone and can’t find people to help me it is difficult for me to move about just to pay my bills water bills,and these applications are difficult to use"

Needs

• To be reminded to pay certain bills at the right time

• A convenient way to track all her bills and payments

• An application that can make his financial life easy

.png)

Notifications: This keeps the users mind at ease, knowing that the payment is being taken care of, it also makes the user aware incase they want to cancel payment or pay now.

.png)

Bill and subscription tracker:

Users can easily manage their bills and subscriptions by switching between tabs.

.png)

Add new bill:

This gives the user the opportunity to create several bills and give a desired name to it.

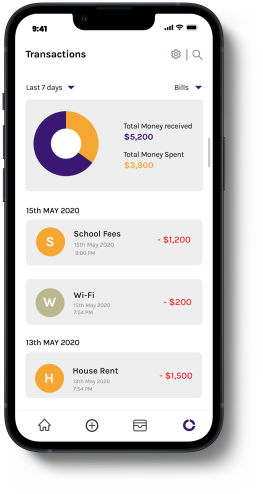

Transaction tracker

Information is displayed in a easy and simple way, which makes it easy for user to keep track of all their upcoming and past payment

Challenges & Takeaways: Initially, I struggled deciding which users to design for, but after research it became clearer. After all, Designing for a specific user can lead to a product that works for other users too.

Future steps: Design for online web application and implement some other major features .